Buying a plot for investment? This is what you need to know!

Owning a piece of land has always been the aspiration of all serious investors! So, when people see advertisements of land being sold within their budget (Rs.2 lakhs to Rs.20 Lakhs), they respond to the same with alacrity.

Through this blog, I am touching upon a few pointers that show typical investor behaviour preparing to buy a plot and also highlighting some thumb rules that he must follow to avoid landing a raw deal.

Several pointers to investor behavior who is making a property deal

Firstly, every diligent investor seeks capital protection of any investment that he plans. He enacts some diligence while buying any plot of land so that he reaps profits from his land.

Secondly, many a times an investor wants accessibility and buys land within driving distance from his place of residence so that he can manage, maintain and protect the same.

Thirdly, people buy land at the native place as its cheaper but they remain at the mercy of the relatives and caretakers to maintain the same. Not only does it create a dependency on third parties but also the apparent appreciation is not so fast in rural places, rather it is extremely slow!

Fourthly, the investor needs to ascertain the status of the land whether it’s a NA (Non-Agricultural) plot or Agricultural plot or an Industrial plot. Local rules differ for each land type and due diligence is needed before he buys any of them.

Here I will talk about NA plot that is meant for residential use. If an investor is buying a NA plot, then he should enquire if the project offers these….

- He should prefer a plot that is in a gated community so that he doesn’t need separate arrangement to protect it from encroachment.

- The gated community should offer basic amenities like road, water, electricity security to the plot owners.

- He should ascertain if there are any recreational amenities like children’s play garden, club house and a swimming pool so that he doesn’t need to spend on building any of these amenities on his plot.

What precautions must an investor take before he finalizes a land purchase with any developer

- Maintenance is a crucial component while purchasing a plot and it is a recurring and permanent expenditure which the customer should always calculate in his investment.

- He should enquire if there a system for maintaining all common facilities and amenities through a provision of corpus fund or a there is a determination on part of the developer to create a functional CHS as he exits the project?

- A large number of the weekend home projects fail because once the builder leaves after handing over the project to society managing committees, its office bearers are not able to maintain it due to non-co-operation from members who don’t pay the maintenance charges and it’s a difficult task for them to collect the payment from the members who are not residing on the project.

Due to this value of the property decreases and the basic purpose of buying land is defeated.

The utmost important factor while purchasing land is doing its Paper Work. Due diligence should be taken to check the title of the property. Compared to built properties (Residential &Commercial) there are a greater number of litigations in the court regarding open lands, especially agricultural lands. An intelligent investor first scrutinizes land records whether agriculture land, farm land in case of NA plot or industrial plot by appointing an advocate specializing in land (Revenue Dept.) related cases.

He should not keep “a penny wise, pound foolish” attitude and always hire an experienced advocate for all real estate transactions. He must ask following papers from the developer and double check details like-

- A copy of the NA ORDER issued by the Collector or Tahsildar

- Sanctioned Plan copy of the plot & bungalow layout

- Survey map of the plot he is planning to buy (issued by T.I.L.R dept)

- Latest 7/12 extract and all mutation entries of the land in which said plot is situated.

- On receiving these papers, his advocate must verify them and issue a public notice of 15 days asking if anybody has an objection for the said plot sale (if any). He should also take out a search report for last 30 years from Land Registration department to check whether there is any double sale of the plot. After getting fully satisfied with the title of the plot, he should issue a “Title clear” certificate and give a draft copy of the agreement for sale or sale deed to be executed in the investor’s name. Only after going through the above-mentioned process should the buyer invest his hard-earned money in any land!

To learn more about how to select the right plot for investment read my book, “Build Real Wealth in Real Estate.”

Written by,

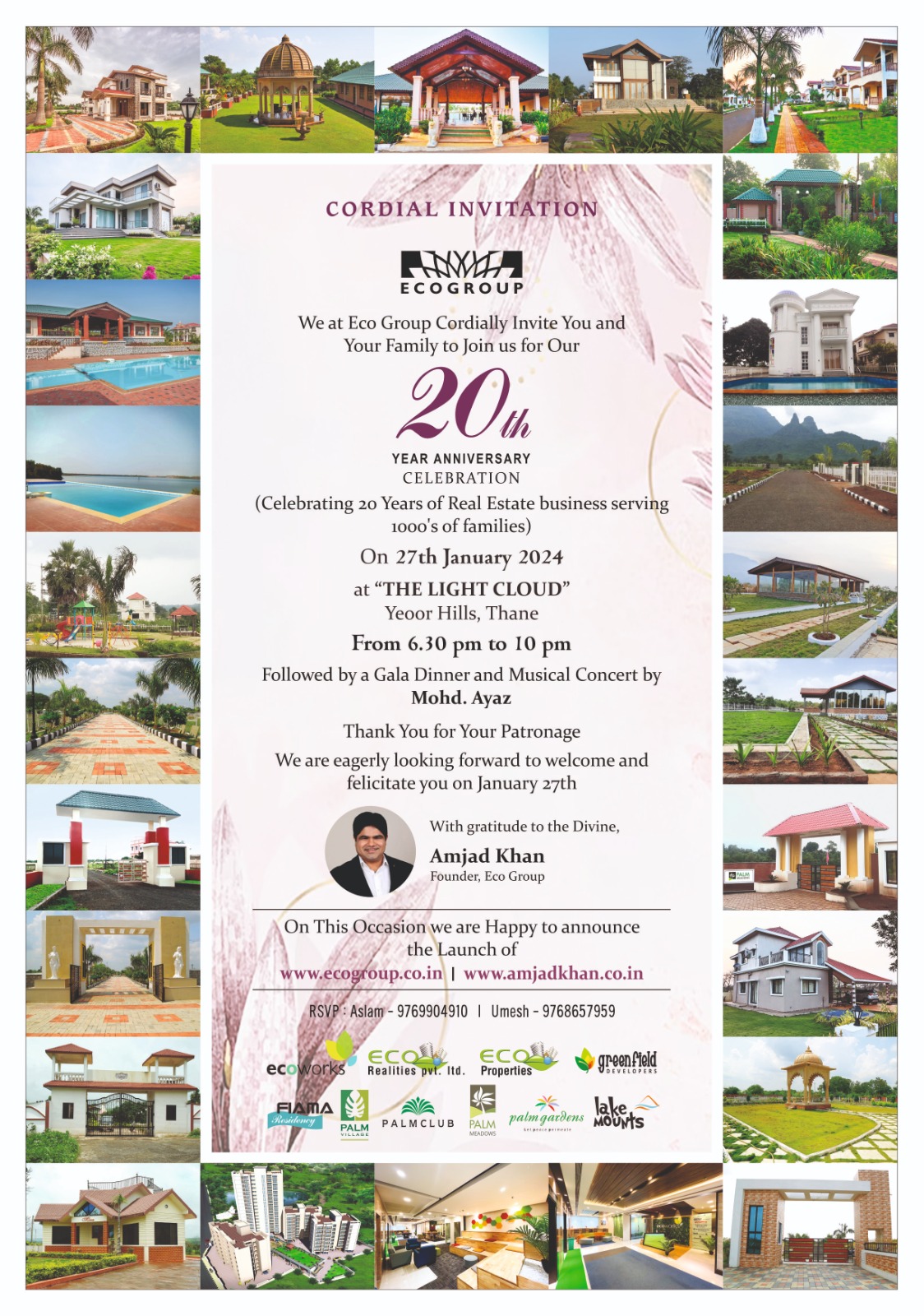

Amjad Khan

Amjad Khan

#1 Best Selling Author,

Real Estate Entrepreneur,

& Real Estate Investment Coach

“Amjad Khan, is the Author of “Build Real Wealth in Real Estate”. He is a real estate “Developer”, “Investor” & “Real Estate Investment Coach”.

He is the Founder & CEO of Eco Group of Companies, a real estate company which has created remarkable residential complexes, Villas and high raise towers in Mumbai, Murbad and places across Maharashtra over past 20 years.

Through his writing, speaking and real estate services, he helps people transform their life from struggling to manage money to save and invest money and build wealth to afford the good life they wish to live.”