Man works hard all his life to secure himself and his family financially. Therefore, is always scouting for ways and means of enhancing his income and makes investment choices to add maximum possible returns and build wealth.

As investors, we build a portfolio of various investment options available in the market. Just as we work hard to earn our money, we need to make our money work hard to earn geater returns for us.

In these series of blogs, I would like to share with you some simpler truths that most experts won’t tell you and explain with illustrations how you can make a wise choice while investing in a property. This is article 1 in which I am addressing the basic issue of calculating the Rate of Return on Property.

How to calculate ROI on property investment

When we invest in property we expect better ROI then bank FDs, right?

At the onset, let us understand how to calculate R.O.I of any property we are considering to buy. Obviously when investing in property, everyone expects Good Rental Returns & better appreciation of the property but not many know how to calculate the ROI of the property they are considering to buy.

Here is a simple illustration to count ROI:

A certain Mr. Suresh buys a 1BHK flat in Thane for Rs.50 Lakhs. After paying the stamp duty & other charges the flat which costs him Rs.60 Lakhs and as per the ongoing rental rates in the area, he gets Rs 15,000/- rent per month.

Now, how we can calculate his ROI on the investment?

Let us first arrive at our Net Rent Figure per month. From Rs 15,000/- rent per month, we need to deduct all outgoings like monthly maintenance charges property tax, agent fees, maintenance expenses etc.

Expenses

Society maintenance charges

Property tax (9000 P.A / 12 months)

Agent commission(1 Rent 15000 /12 months)

Maintenance & upkeepment expenses (Repainting & Repair etc) assuming 12000/- per year

Total

Monthly

Rs. 2,000/-

Rs.7,50/-

Rs. 1250/-

Rs. 1000/-

Rs. 5000/-

Therefore, Net rent per month in hand is Rs 10,000/- only, here we have not considered the non-occupancy period.

Net rent per year Rs. 10000 x 12 months : Rs. 1,20,000/-

Now apply this formula to arrive on exact percentage of return

Net Rent x 100 = Net Rental Return per Annum

Total Value

1,20,000/- x 100 = 2 % Rental Return per Annum

6000000

Now add the expected price appreciation in the location where the property was bought. Let us assume Mr. Suresh gets 5% price appreciation per annum on the property. This means his Rs. 60 Lakhs property appreciates to Rs. 63 Lakhs by next year. Then this total ROI or rent to price ratio R/P will be 5% appreciation + 2 % (rental return) = 7% ROI

In case of residential property average price appreciation in MMR region is within the range of 3-5% only. You can study the Rent to Price Ratio before investing . A simple thumb rule is that “Lower the rent to price ratio; the worst is the property for investment”.

Depending on the location & market conditions, we must realize that different categories of Real Estate give varied Rate of Returns (ROI) as we see in the table given below for the MMR region (Mumbai Metropolitan Region):

Houses give ROI of around 7 %

Shops give ROI of around 10 %

Offices give ROI of around 11 %

Warehouses give ROI of around 12 %

(2% rental returns + 5% appreciation)

(3% rental returns + 7% appreciation)

(5% rental returns + 6% appreciation)

(8% rental returns + 4% appreciation)

- Study the market do proper due diligence before investing in any property

- Read my book “Build Real Wealth in Real Estate” to know more about how to select the best investment property by applying property evaluation matrix to maximize your Return on Investment (ROI).

Written by,

Amjad Khan

Amjad Khan

#1 Best Selling Author,

Real Estate Entrepreneur,

& Real Estate Investment Coach

“Amjad Khan, is the Author of “Build Real Wealth in Real Estate”. He is a real estate “Developer”, “Investor” & “Real Estate Investment Coach”.

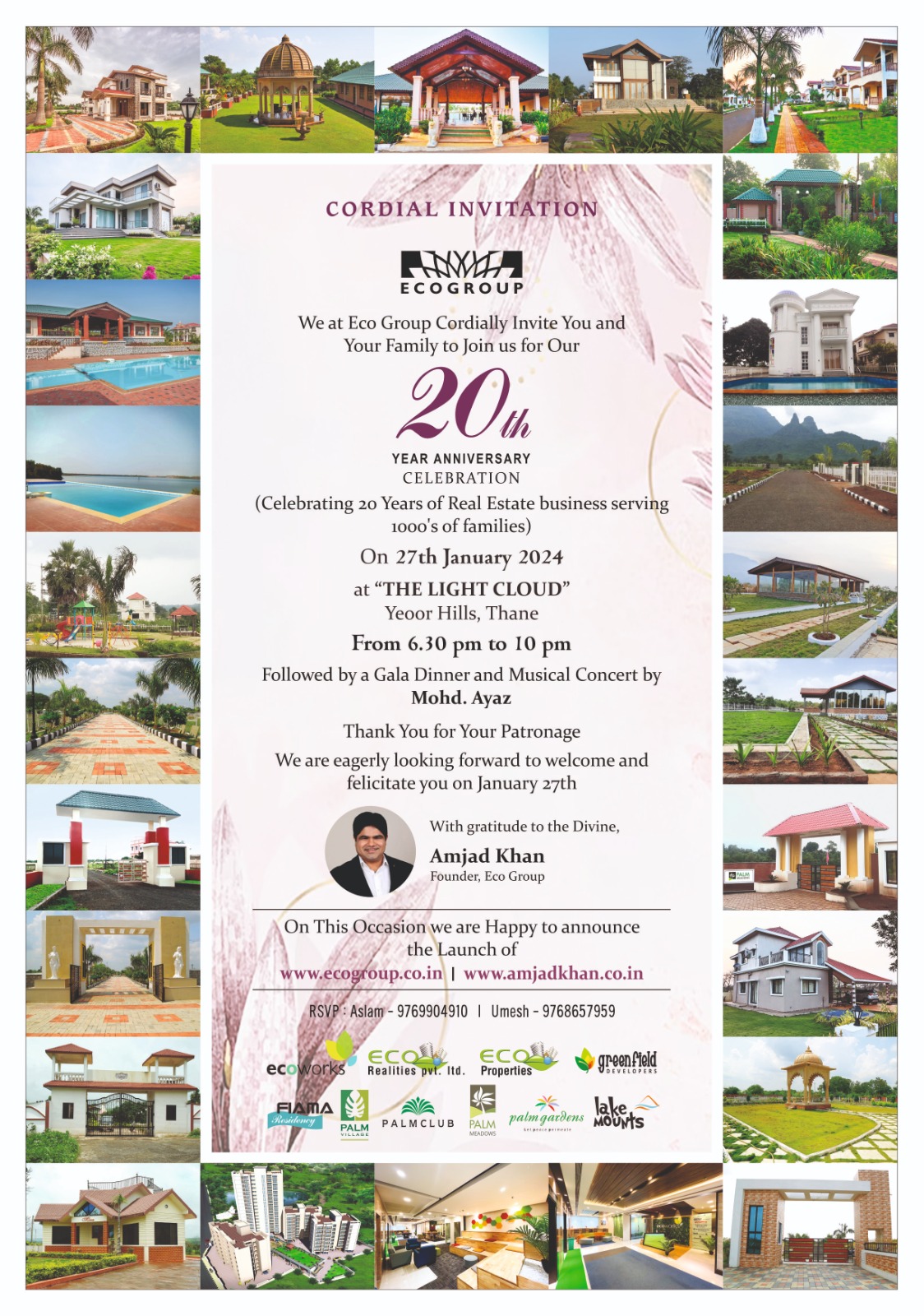

He is the Founder & CEO of Eco Group of Companies, a real estate company which has created remarkable residential complexes, Villas and high raise towers in Mumbai, Murbad and places across Maharashtra over past 20 years.

Through his writing, speaking and real estate services, he helps people transform their life from struggling to manage money to save and invest money and build wealth to afford the good life they wish to live.”